What Is Form 1099C Used For?

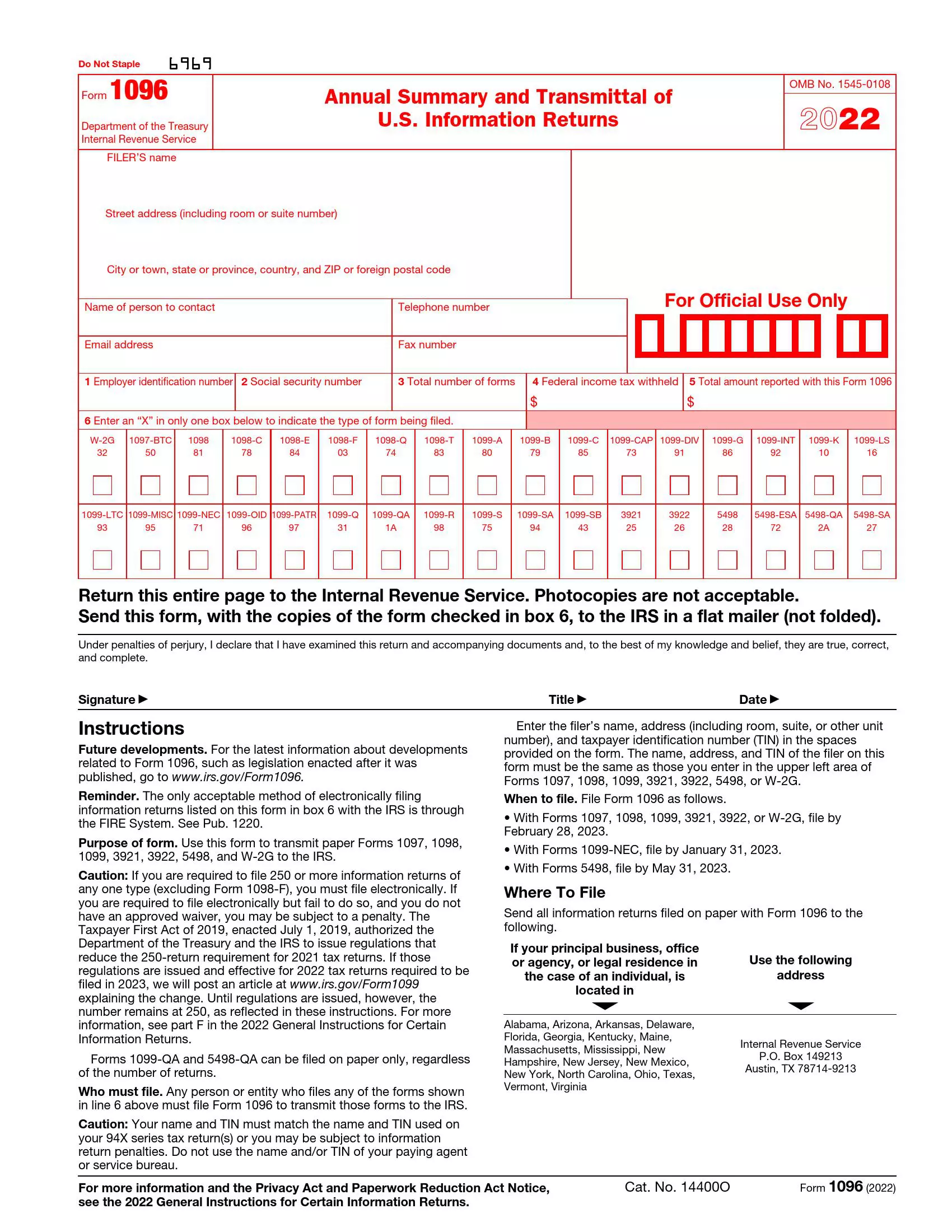

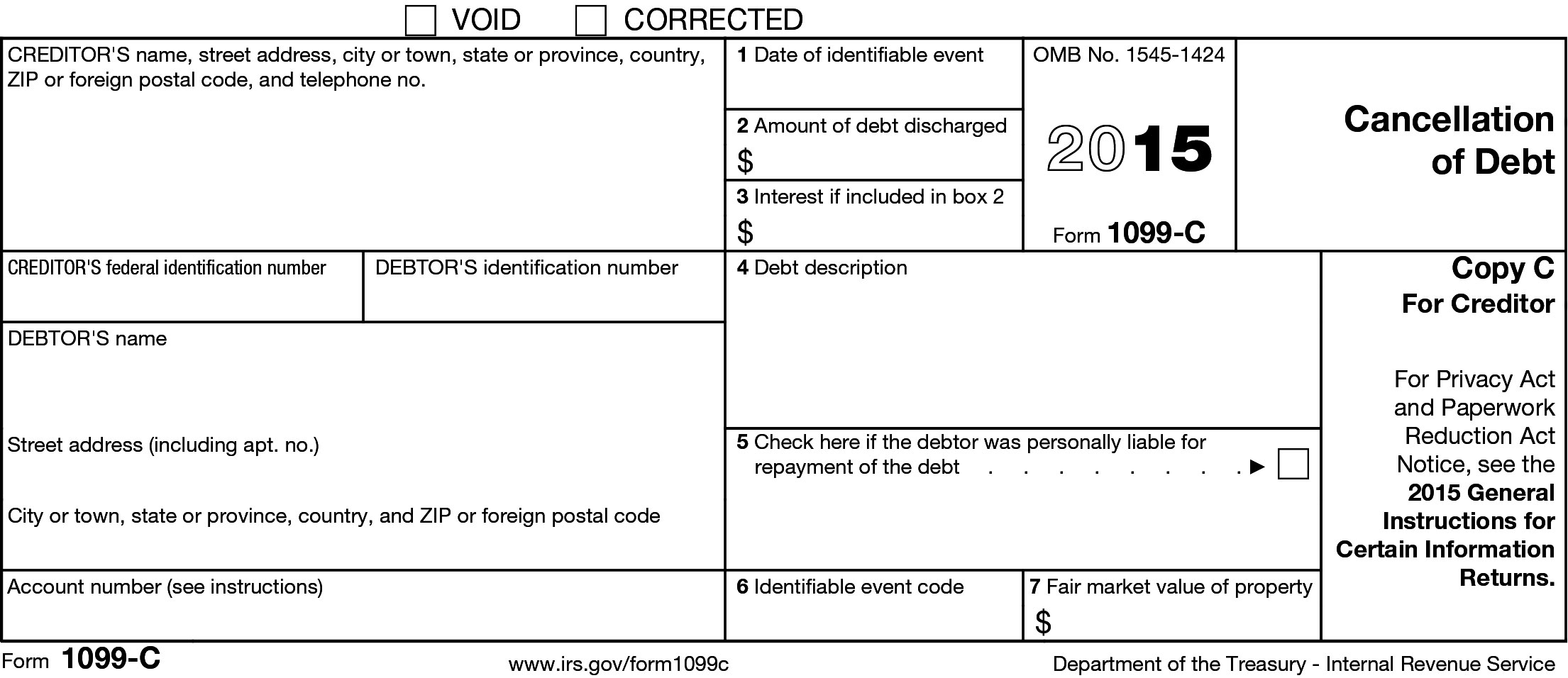

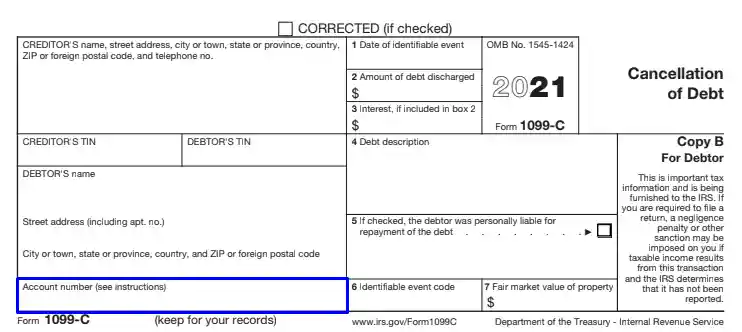

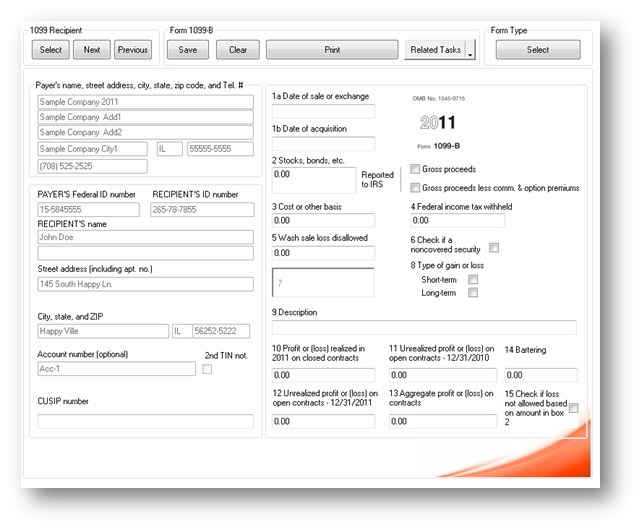

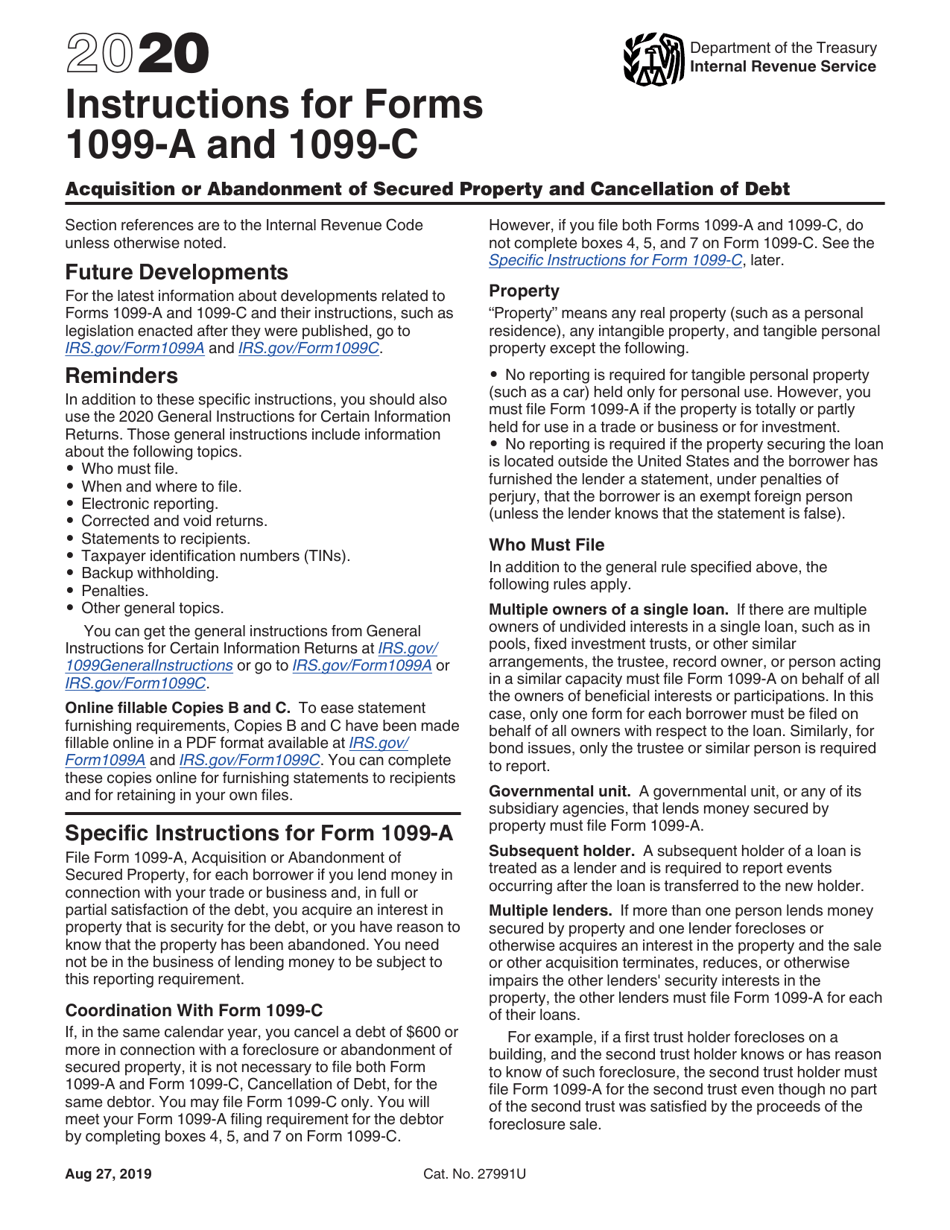

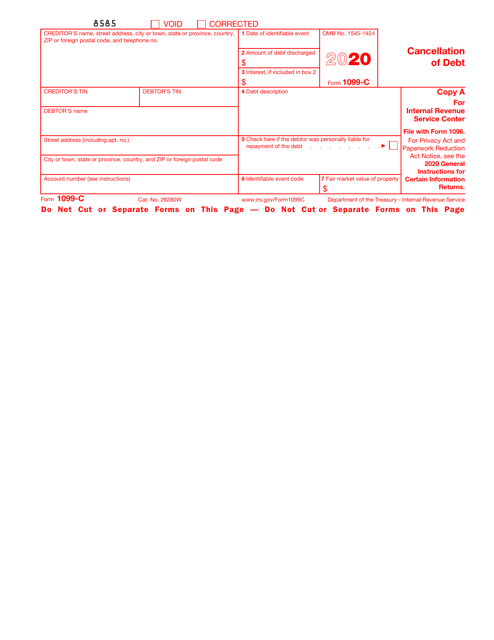

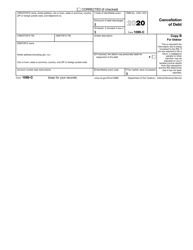

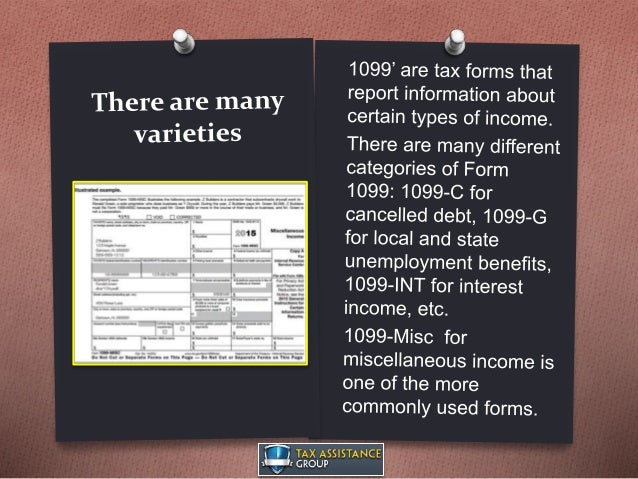

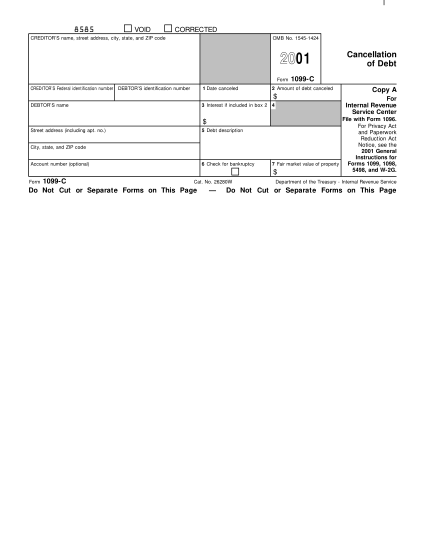

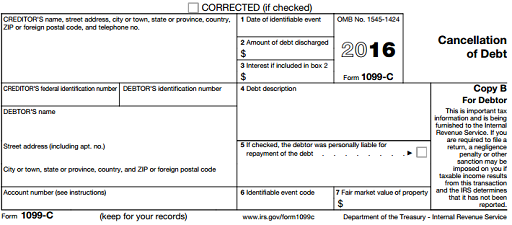

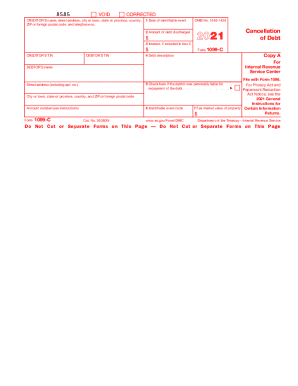

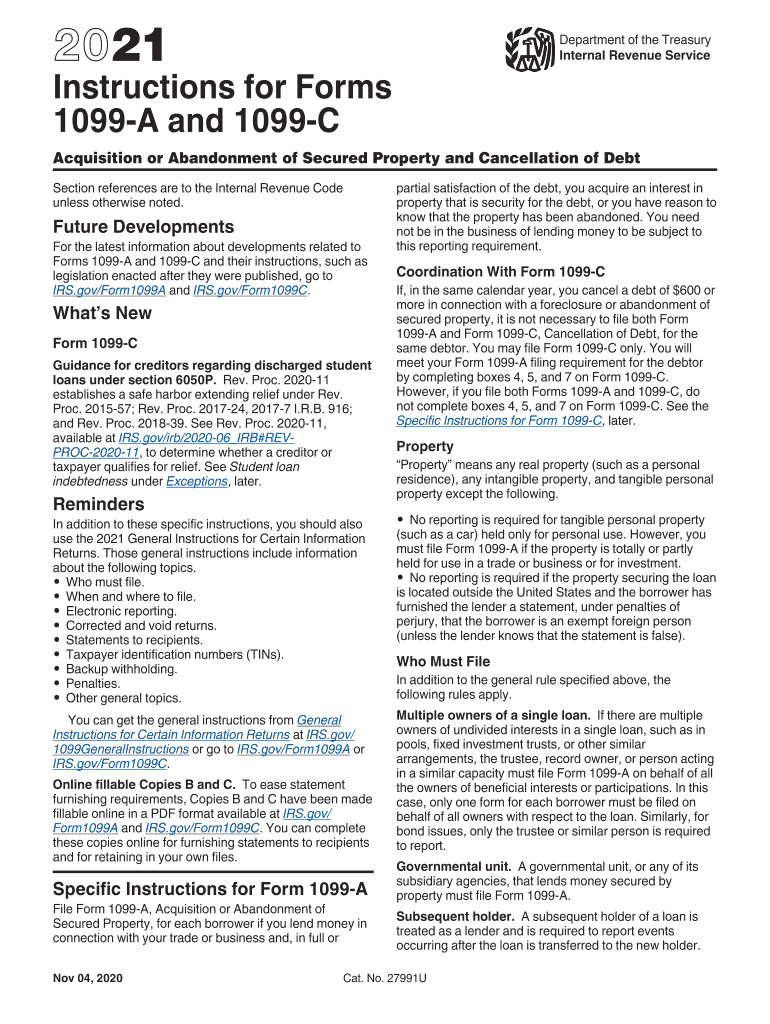

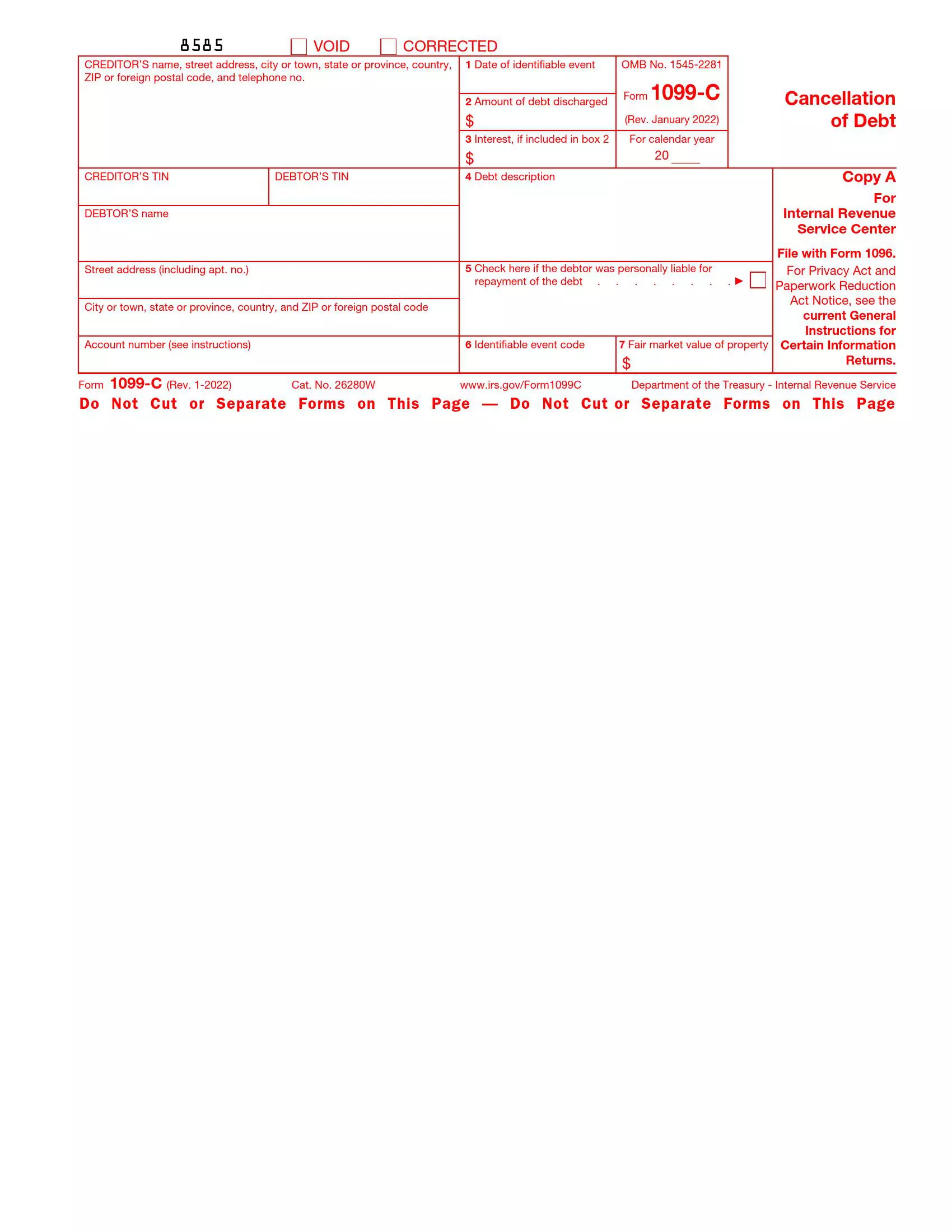

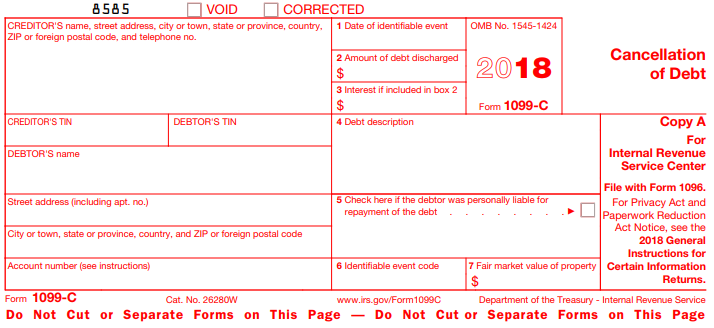

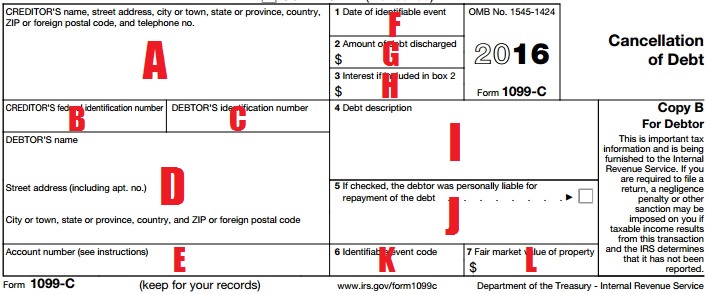

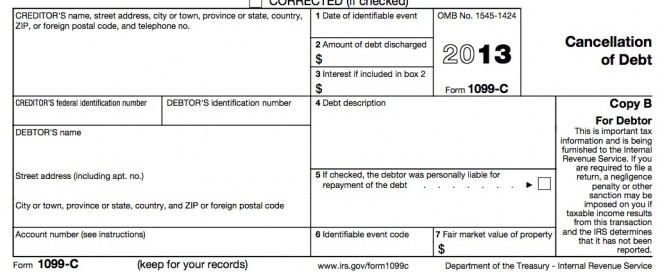

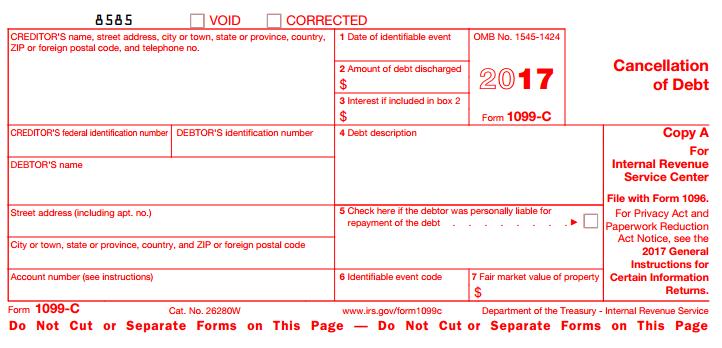

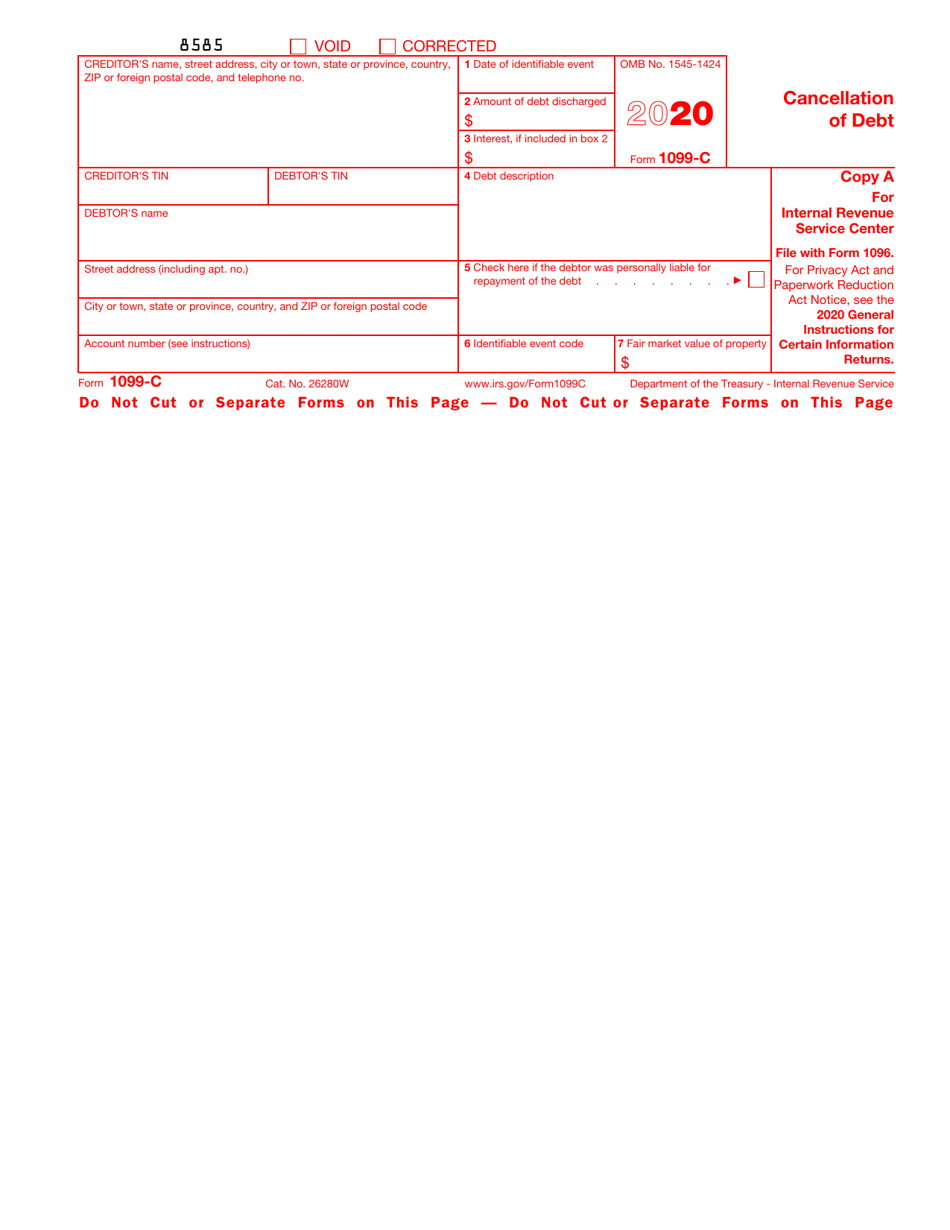

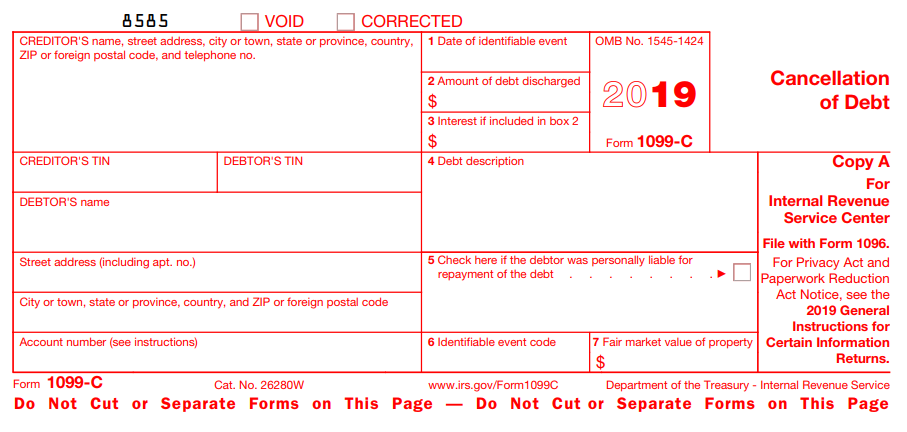

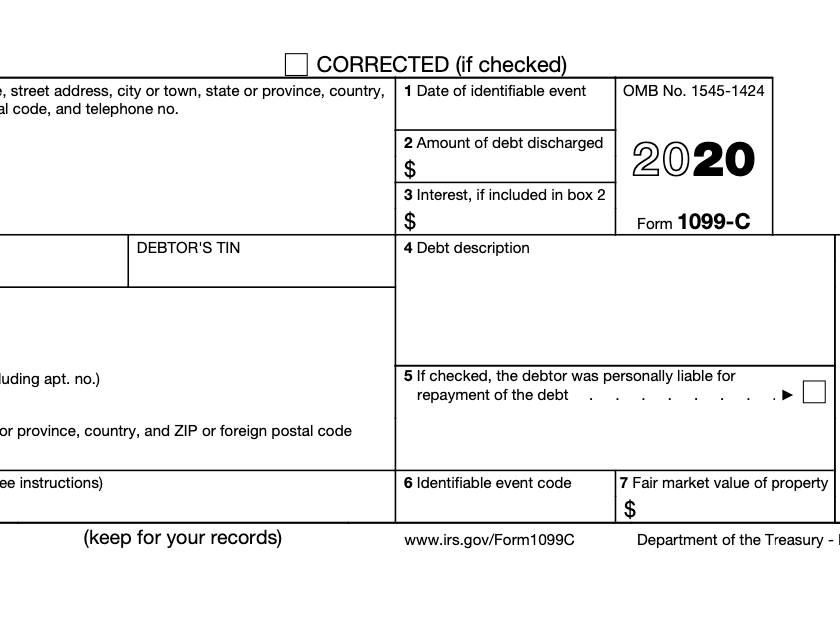

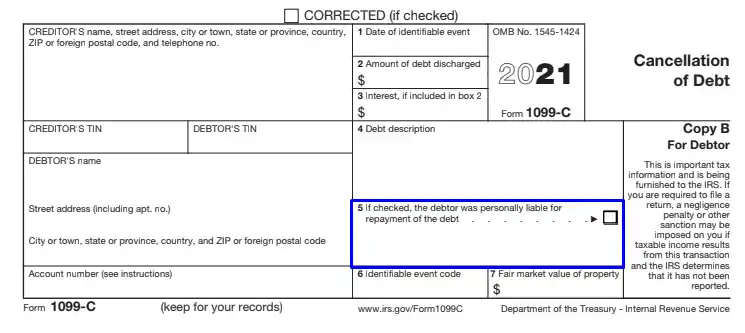

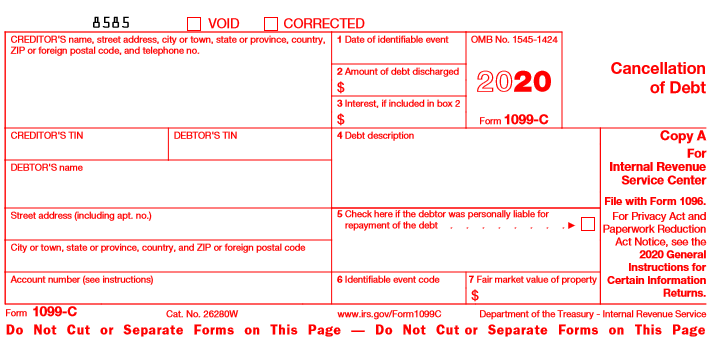

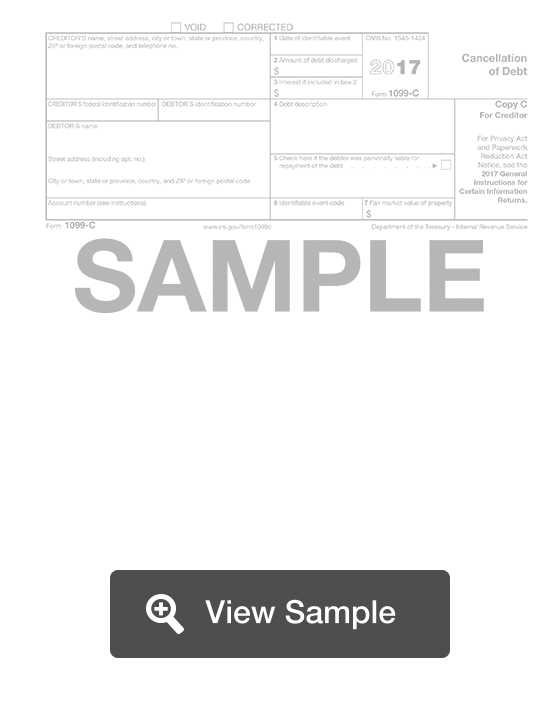

Irs 1099-c form 2019- Form 1099C Cancellation of Debt is required by the Internal Revenue Service (IRS) to report various payments and transactions made to taxpayers by lenders and creditors These entities must fileForm 1099C is mainly used to report the cancellation or forgiven of debt worth $600 or more The creditor or the lender submits the Form 1099C to the IRS and also a copy to the debtor Later, the debtor reports this debt amount on his/her income tax return

Irs 1099-c form 2019のギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

|  | |

|  |  |

|  |  |

|  | /AP675784005308-b2feecc49e7548ac96fcdb74bdab63b4.jpg) |

「Irs 1099-c form 2019」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

| ||

|  | |

|  |  |

「Irs 1099-c form 2019」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

:max_bytes(150000):strip_icc()/1099-A-0151e1f82f624920b802b26d693d47f6.jpg) |  |  |

| /1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg) |  |

| /paying-medical-debt-with-credit-card-999e507c2a4f4580a71db69b6269377c.jpg) |  |

「Irs 1099-c form 2019」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | /1099-C-69a52b42698048d68609c2c79946530d.jpg) |

|  |  |

|  |  |

「Irs 1099-c form 2019」の画像ギャラリー、詳細は各画像をクリックしてください。

| ||

|  | |

|  |  |

|  | |

「Irs 1099-c form 2019」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  |  |

|  |  |

「Irs 1099-c form 2019」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg) |  |  |

|  | |

|  | |

「Irs 1099-c form 2019」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | /1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png) |

|  |  |

|  | |

「Irs 1099-c form 2019」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  |

The 1099NEC is the main form for reporting selfemployment income, and any business that pays a lot of nonemployee compensation will have to deal with several of these forms every tax season These forms are pretty straightforward to fill out and file provided you have important information such as the recipient's tax information and total amount paid in nonIf you have questions about reporting on Form 1099C, call the information reporting customer service site toll free at or (not toll free) Persons with a hearing or speech disability with access to TTY/TDD equipment can call

Incoming Term: 1099 c form irs, irs 1099 c form 2020, irs 1099 c form 2021, irs 1099-c form 2019, irs form 1099-c instructions, irs 1099 schedule c form,

0 件のコメント:

コメントを投稿